Allu Arjun-starrer Pushpa 2: The Rule, for instance, made over ₹1,233 crore at the box office, while digital, satellite and music rights brought in around ₹400 crore for the makers.

Other titles such as period drama Chhaava and horror comedy Stree 2, which unexpectedly went to earn around ₹600 crore each at the box office, are estimated to have each earned between ₹120 crore and ₹130 crore from the sale of ancillary rights, according to trade experts.

The experts pointed out that OTT (over-the-top) platforms have become cautious and selective, reducing their contribution to a film’s overall revenue to 30% or less, compared to over 50% during the pandemic. Alongside, the satellite TV market has cooled precipitously and music rights are on the decline.

This indicates that cinemas are back to bringing the biggest chunk of returns, prompting filmmakers to begin to produce and market films for theatres first.

According to the Ficci-EY media and entertainment report 2025 that was released in March, incomes from theatrical releases accounted for over 70% of the overall revenue of a film in 2024, while ancillary rights like digital and broadcast brought in 23%. In contrast, in 2021, theatricals made up 48% of the overall revenue of a film, while ancillary rights contributed 50.5%. Further, in 2024, satellite TV rights sales stood at ₹1,300 crore, significantly lower than ₹2,100 crore in 2018.

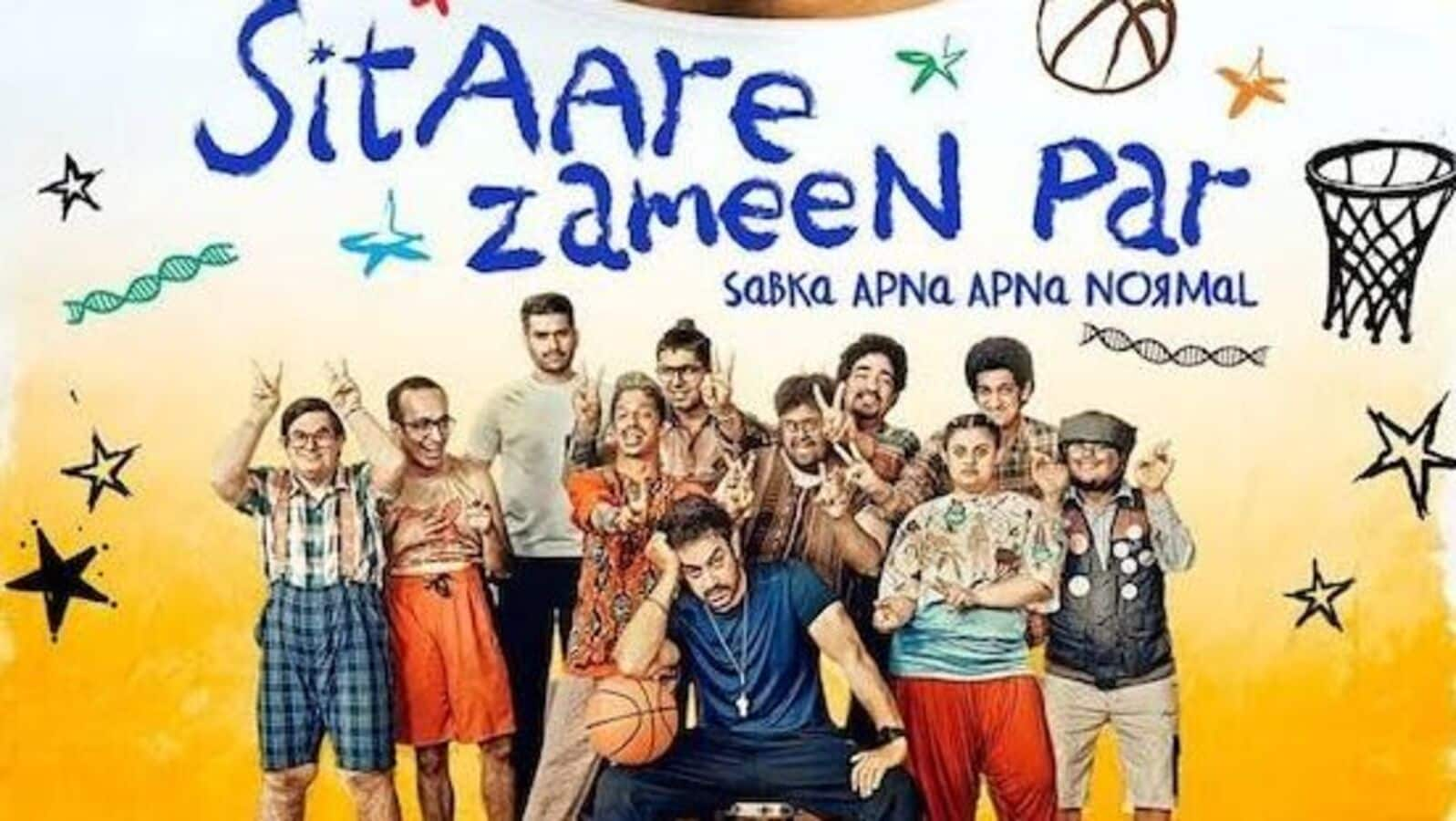

Ashish Saksena, chief operating officer, cinemas, BookMyShow, pointed out that the industry is witnessing a recalibration, where producers, especially those investing in mid-to large-scale stories, are anchoring their strategies around a theatrical-first model once again. A case in point is Aamir Khan’s deliberate decision to give his production Sitaare Zameen Par a theatrical release and retain the theatrical window run for a long duration. Calling it a thoughtful reaffirmation of cinema as a communal experience form, Saksena said it signals renewed confidence in the box office while reasserting the enduring value of the big screen format.

Film producer Anand Pandit said that OTT platforms and satellite channels are more selective now with what they acquire, and even music revenues depend heavily on social media traction.

“These platforms still contribute, but they’re no longer leading the way like they did for a few years,” Pandit said. “This is an opportunity to expand our imagination beyond old revenue models and focus on theatrical releases. This is the time to create immersive, emotionally resonant cinema that can draw audiences to theatres.”

“Movie channels were, at one time, drivers of reach, but that isn’t the case anymore,” Neeraj Vyas, former business head, Sony Entertainment Television, Sony SAB, PAL and Sony MAX Movie Cluster, had told Mint in an earlier interview. “There have been many FTA (free-to-air) launches that take eyeballs away from the pay TV universe.”

Entertainment industry experts like Pandit emphasize that OTT platforms are no longer in the content-buying race the way they were in 2020-21. Their focus has shifted from quantity to quality and profit. Satellite channels, on the other hand, are dealing with changing audience behaviour.

TV viewership patterns are shifting, especially among younger audiences, and advertising revenue doesn’t support the acquisition of films at exorbitant rates. As a result, they’ve become very selective, too.

Further, with music, only a few songs really break out and drive revenue in a market where paid subscriptions aren’t exactly growing. Unless something goes viral, the returns are limited. So overall, purse strings are tightening across the board. The market has changed, and the easy pre-release revenue models producers once relied on have shrunk.

“Prices have now rationalized after the initial bubble burst. Producers are back to relying on revenues from the theatrical business and the good part is films are also breaching the ₹500-600 crore box-office mark. This means the theatrical model is robust and you just have to ensure the content and math of the budget are right,” said Bhumika Tiwari, head of content acquisition and film distribution (worldwide) at Dharma Productions.

Over the past two years, films like Pathaan, Jawan, Gadar 2, Animal, Stree 2 and Chhaava have crossed the ₹500-600 crore mark at the box office.

“We’ve seen first-hand how the theatrical ecosystem in India has consistently anchored the film industry’s commercial and cultural relevance. While the revenue mix has evolved over the years, theatrical contribution is one metric that has been steady in the life cycle of a film. Its ability to generate both economic value and audience engagement at scale, repeatedly is unmatched,” Saksena said.